Automate Bank Reconciliation With Sage Enterprise Management

05 Jul 2018 | by Brett Mundell

Checking that your business’ transactions match what appears on your bank statement is important part of maintaining financial health. But while it’s essential housekeeping, it’s also tedious and traditionally labour-intensive.

When a company has multiple entities that may be spread across multiple countries, each with separate bank accounts that must be balanced, the job becomes even more complex.

Bank reconciliation challenges in complex financial environments

For businesses with multiple ABNs and associated bank accounts, or with operations and accounts set-up across a number of locations, accounting can become complicated.

Many small to medium-sized enterprises now operate different streams of business, each with their own ABN, income, expenses, tax obligations and financial reporting requirements.

When an extra layer of complexity is introduced as your company grows or diversifies its operations, it can make it problematic to ensure all payments, costs and fees are being allocated to the correct ABN.

Why worry about improving your bank reconciliation process?

A regular bank reconciliation helps ensure your company has accurate accounting records and is maintaining adequate cash balances. If you have less cash than expected it can impact day-to-day working capital needs, or you run the risk of incurring overdraft fees or “bounced” payments.

Bank reconciliation also helps to identify discrepancies—which could be the result of fraud or errors that need to be rectified quickly so that financial statements are up-to-date.

Traditional bank reconciliation processes are manual, slow and fiddly, requiring finance employees to enter all payments, review and check-off every transaction line by line.

Streamline, save time and reduce errors

Your finance team could find a better use of their time than scrutinising every line of each bank statement for each ABN you hold. What if the process was almost entirely automated?

Bank reconciliation in complex, multi-company or multi-site businesses can be automated with the right software solution. Many of our customers have experienced time and efficiency savings by implementing Sage Enterprise Management (Previously Sage X3) to streamline key accounting processes.

By working with Leverage Technologies, Sage’s ERP software can be configured to meet your company’s precise needs. For instance, we can assist you to:

- Set-up all existing entities, with the ability to add/remove additional ABNs and accounts.

- Access automated feeds from each bank account you hold.

- Determine the structure of the bank statement data file in liaison with your bank.

- Based on the volume of your transactions, define anticipated timing of reconciliations.

- Create user-defined criteria and fields to support automatic matching of entries.

- Create references for each company and criteria to automate inter-company transactions.

Configured properly, the automated process is fast and user-friendly, cutting many hours of manual handling from your employees’ workload and freeing them to focus on more strategic financial management tasks.

How to conduct an automated bank reconciliation in Sage Enterprise Management

This is how easy it is to conduct the automated reconciliation process in Sage Enterprise Management.

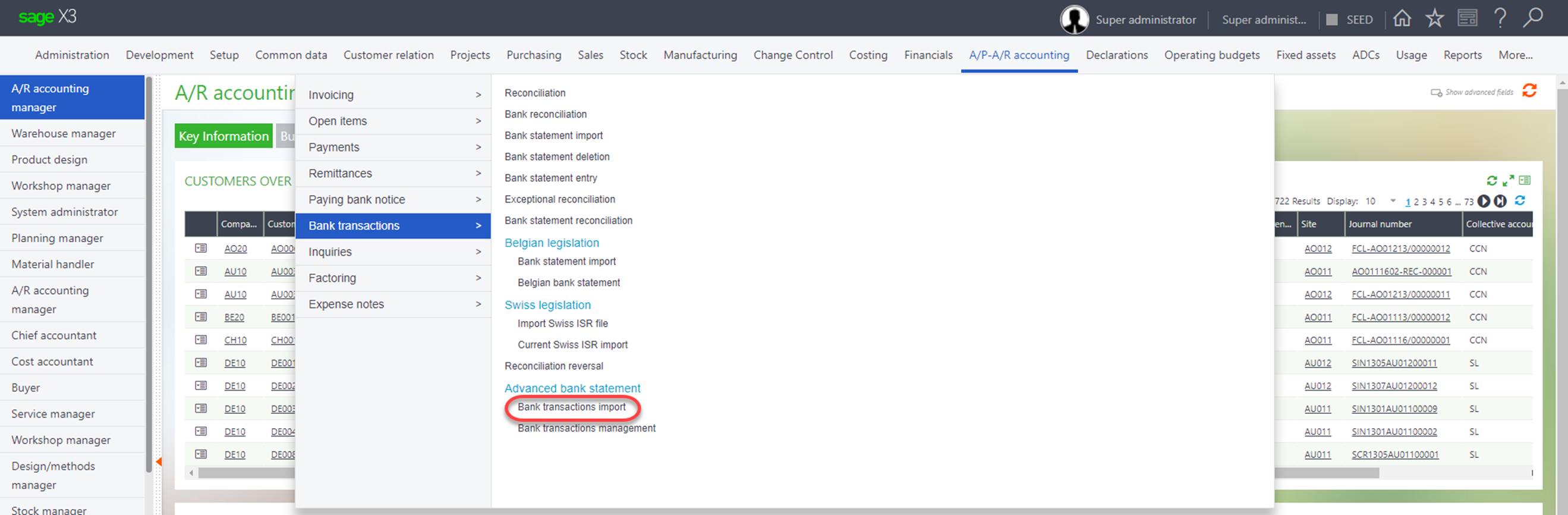

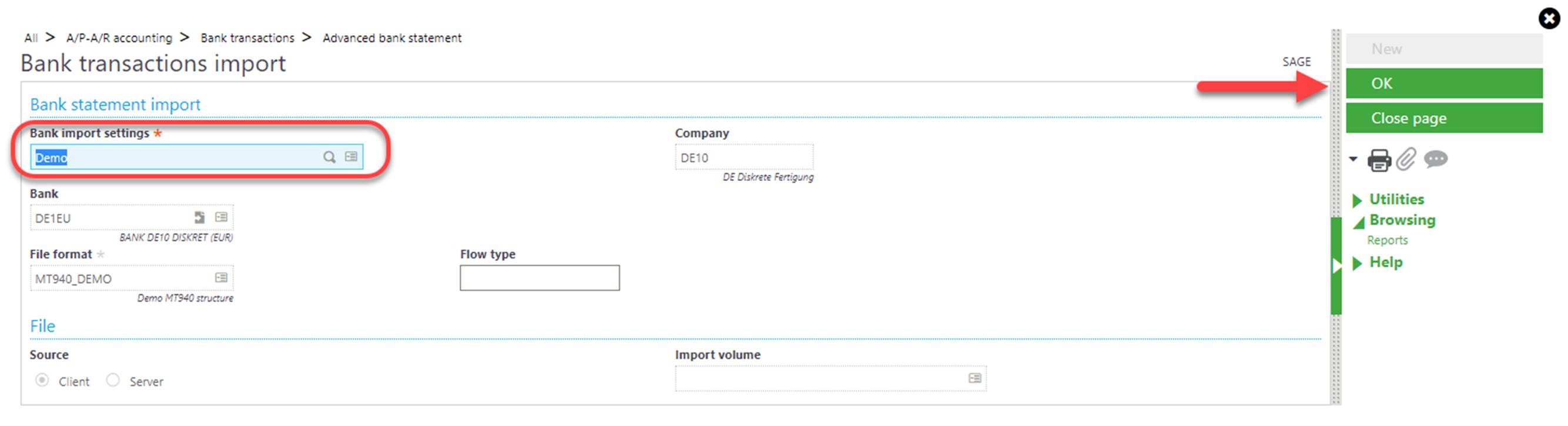

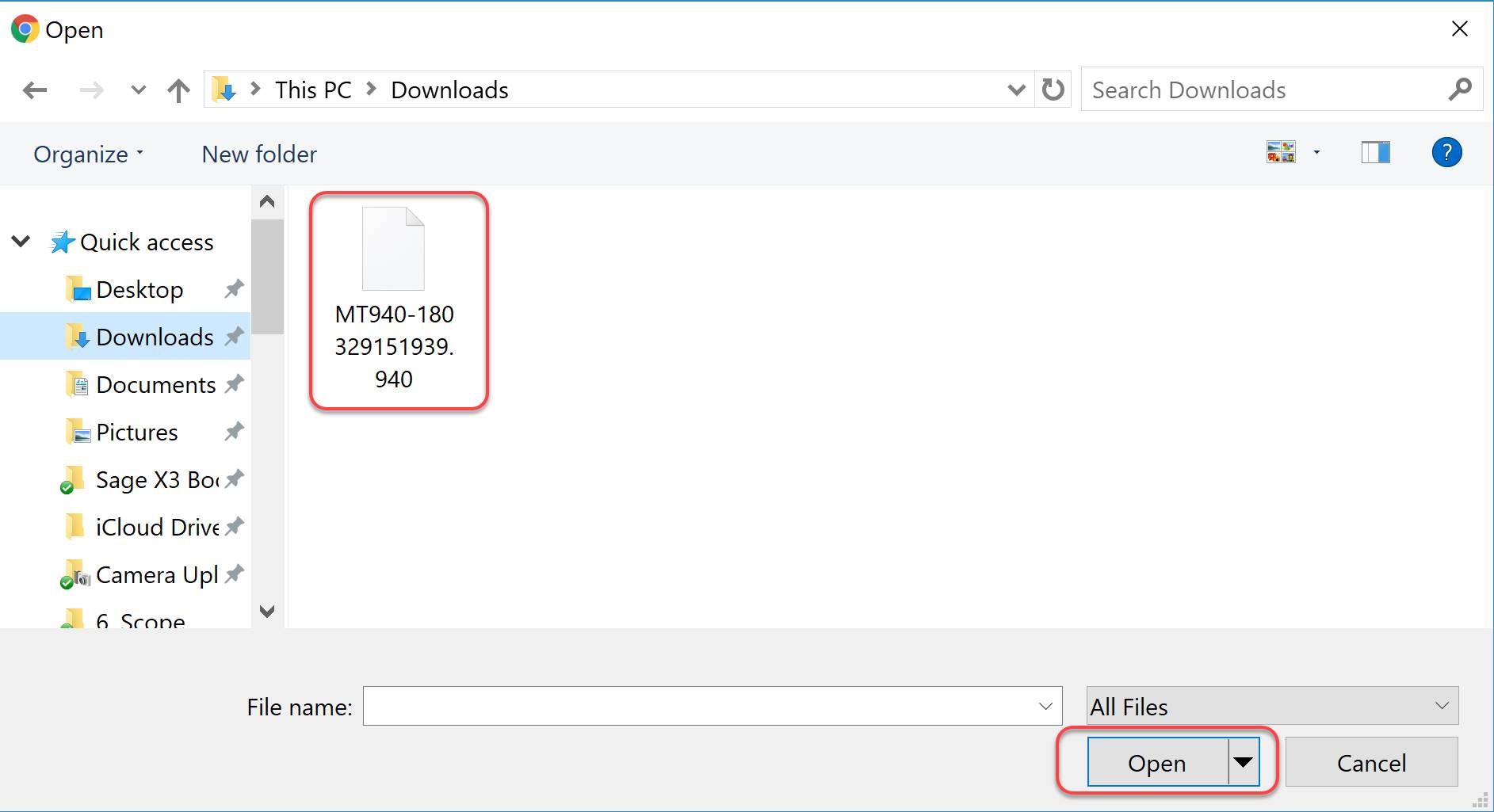

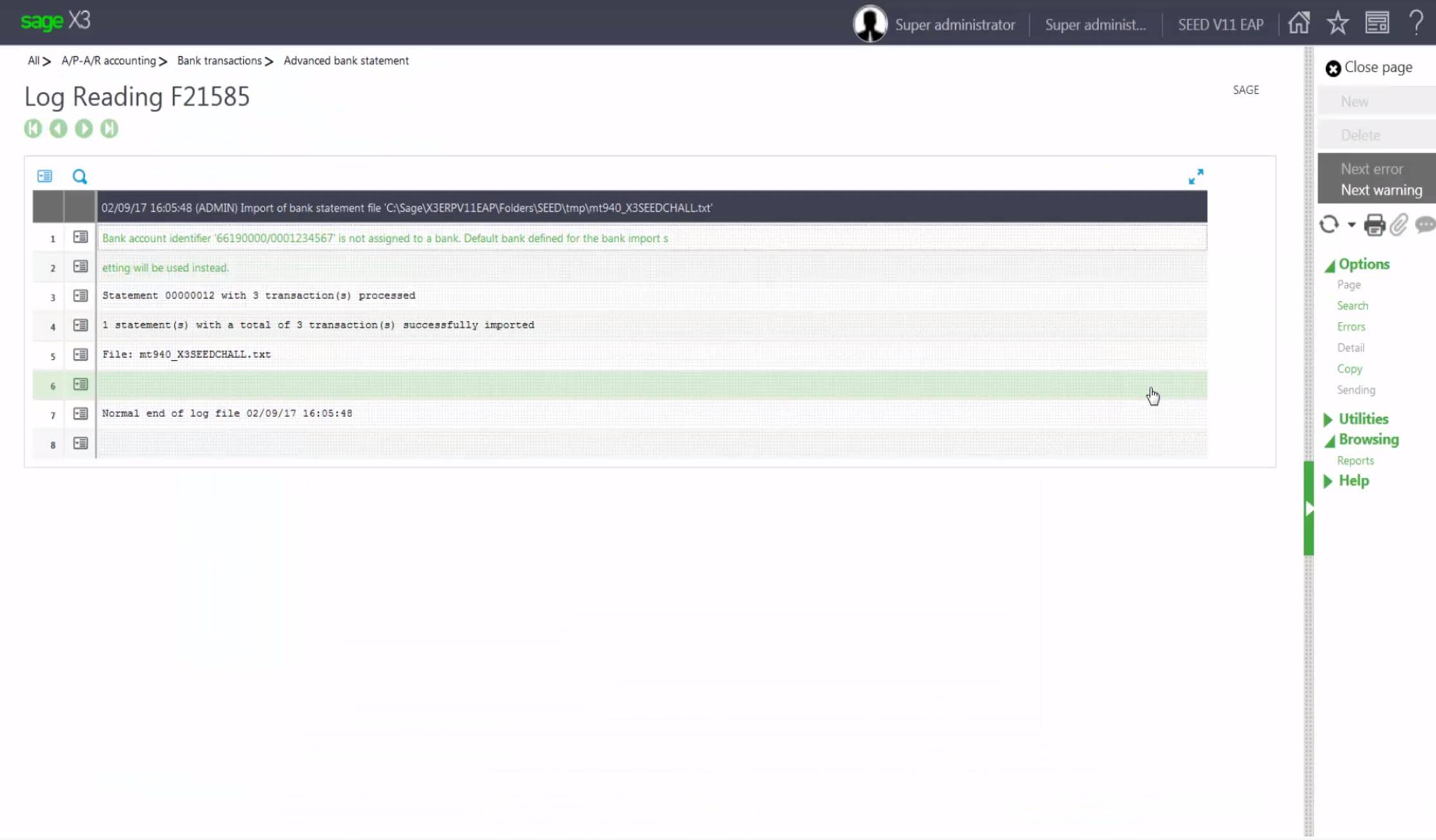

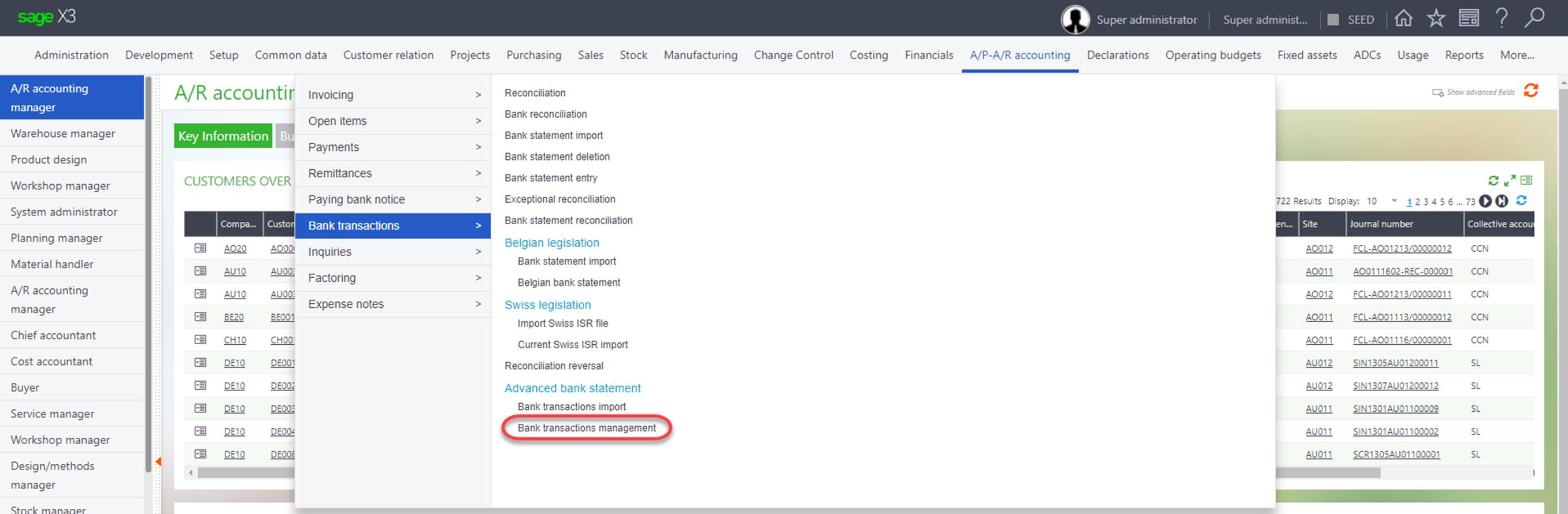

#1 – Import your latest bank statement files for each account

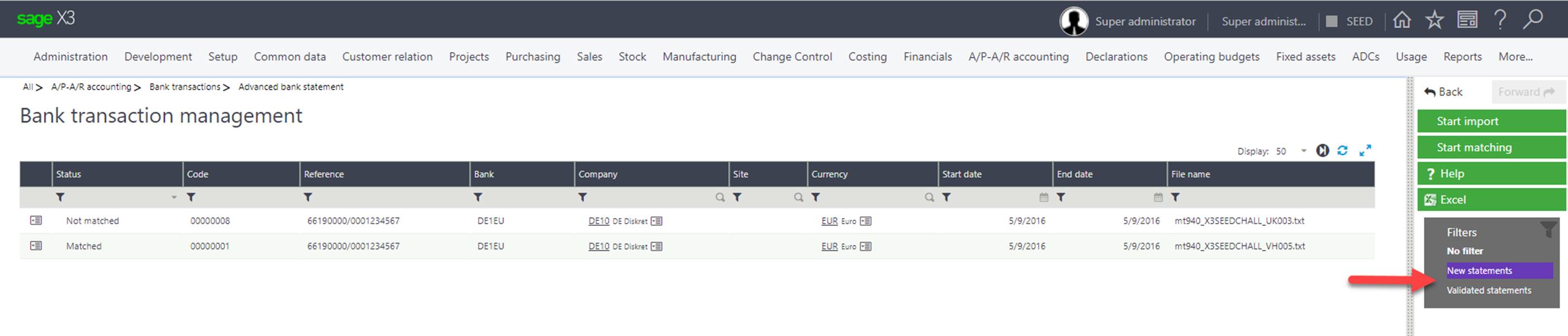

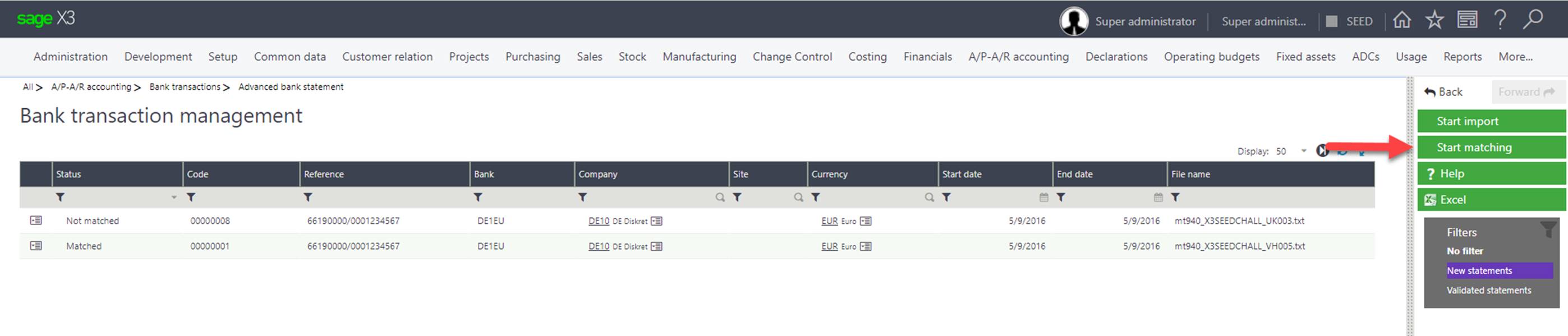

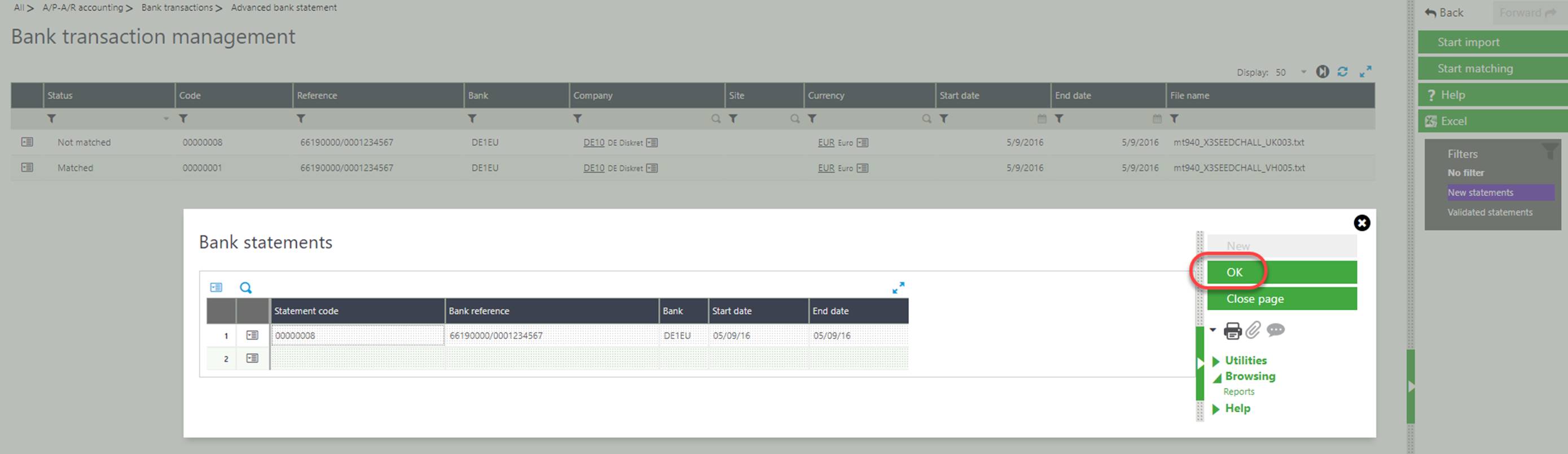

#2 – Filter your imported bank statements by ‘new statements’ and start automated matching

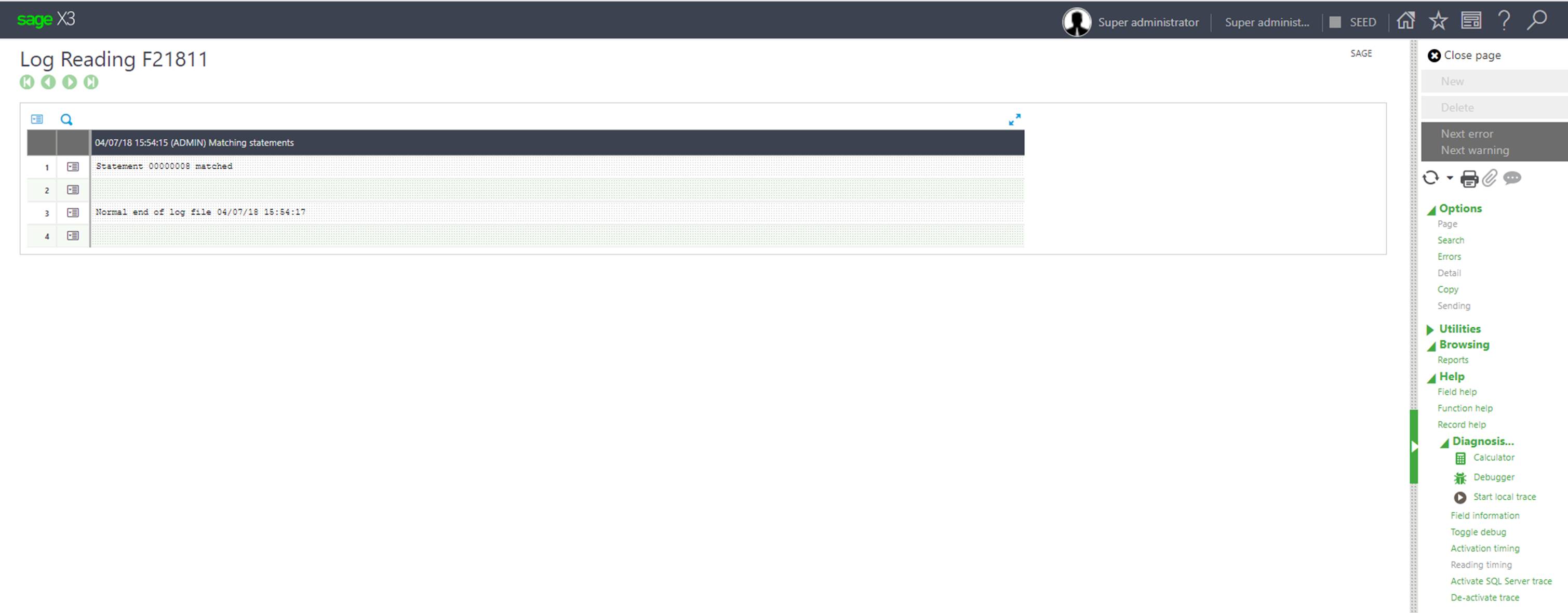

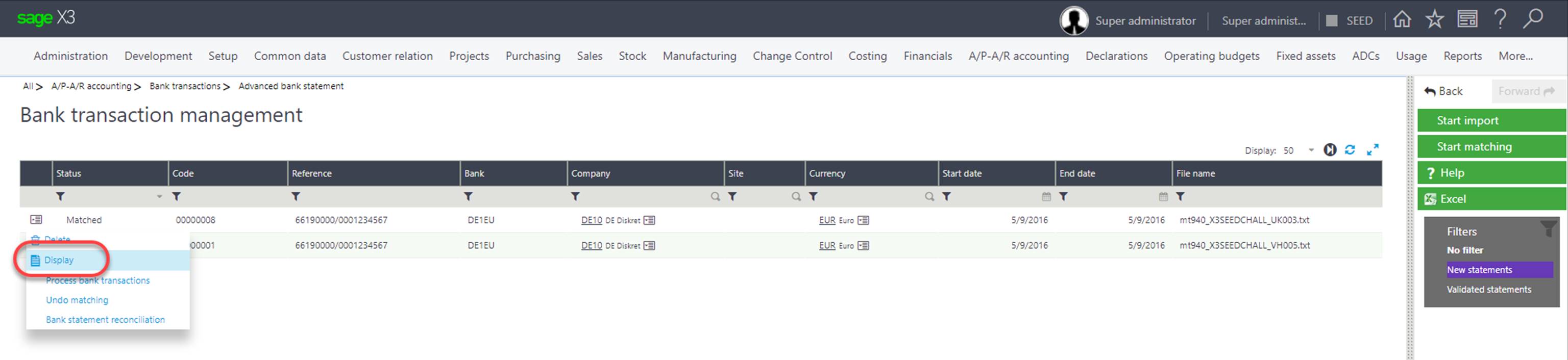

#3 – Using the action button on the line of the statement, select ‘Display’ to preview which transactions were matched. The code field represents the status of transactions by code (A, B, C) indicating: matched exactly (A); open items were found and a potential partial match (B); or no open items found (C)

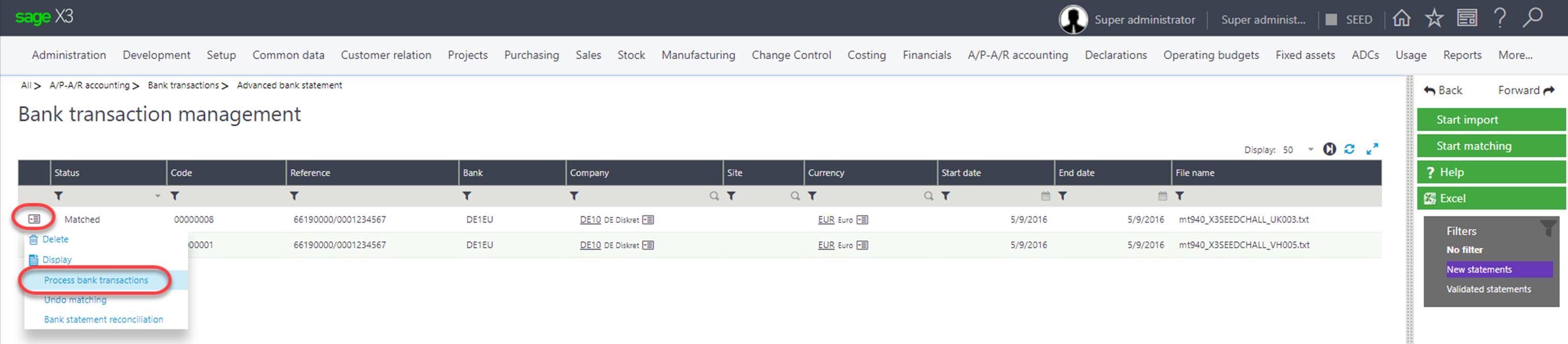

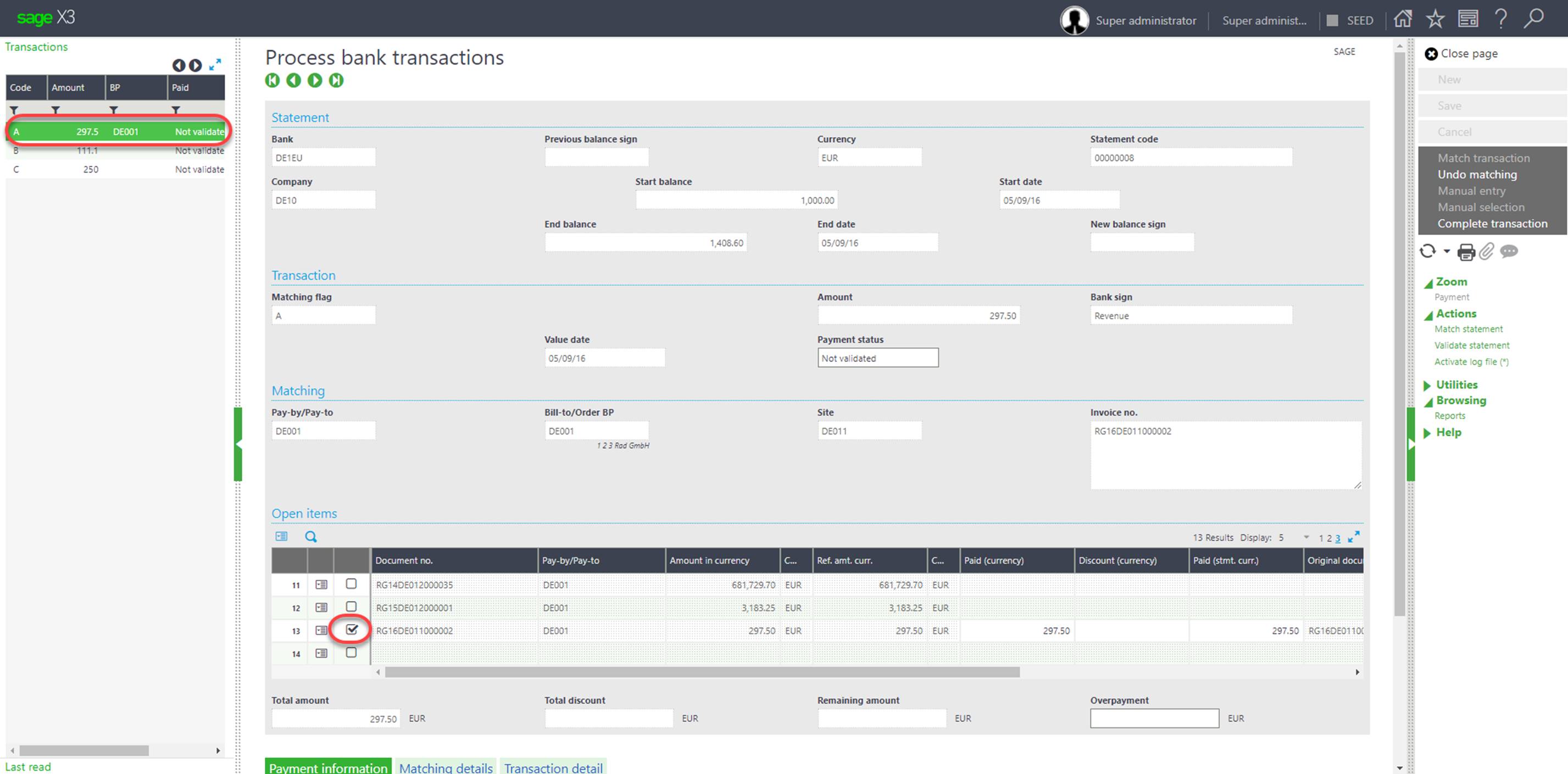

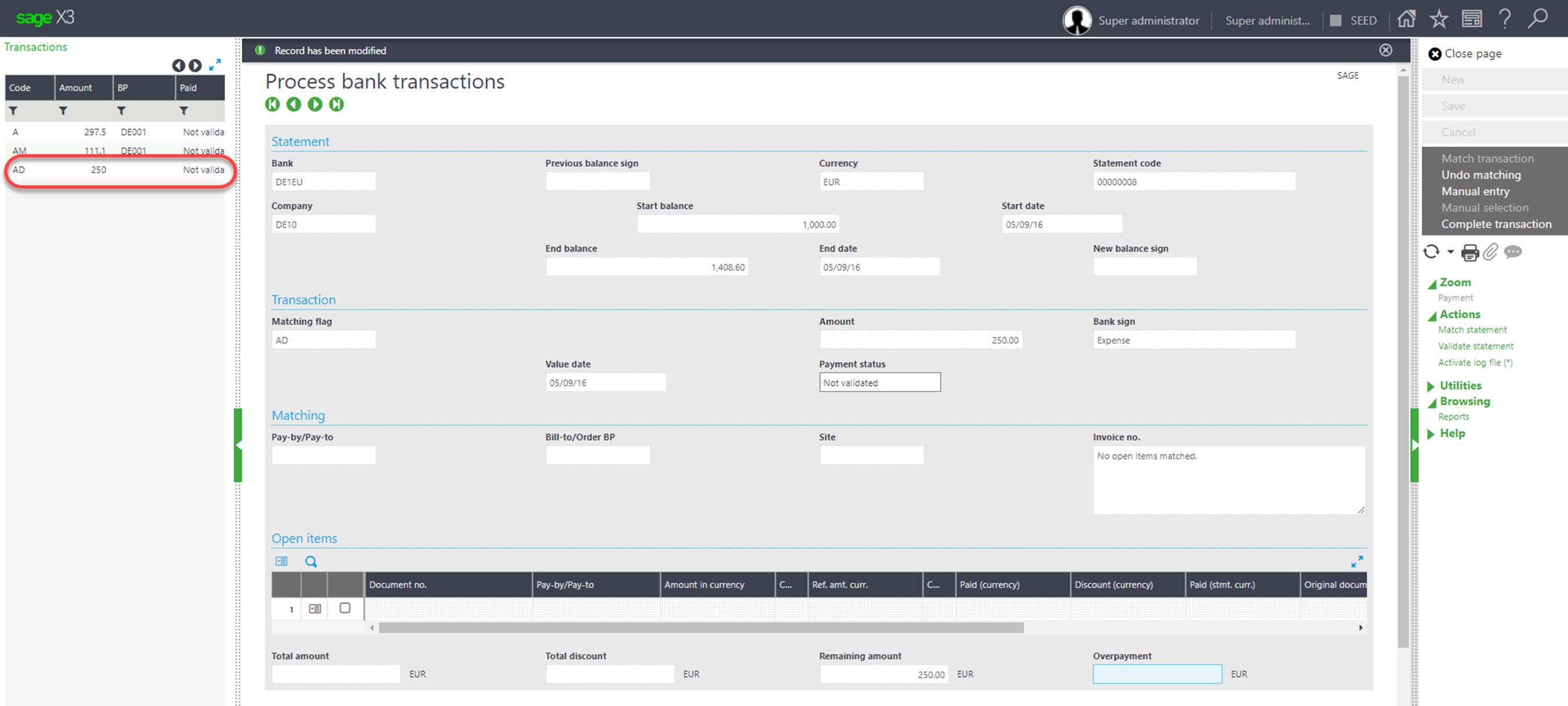

#4 – Select to display the ‘Process bank transactions’ screen to see detailed information about matching and work with the statement.

#5 – If you select the completely matched item (A) in the left list, you will notice which transaction it matched to in the open items section

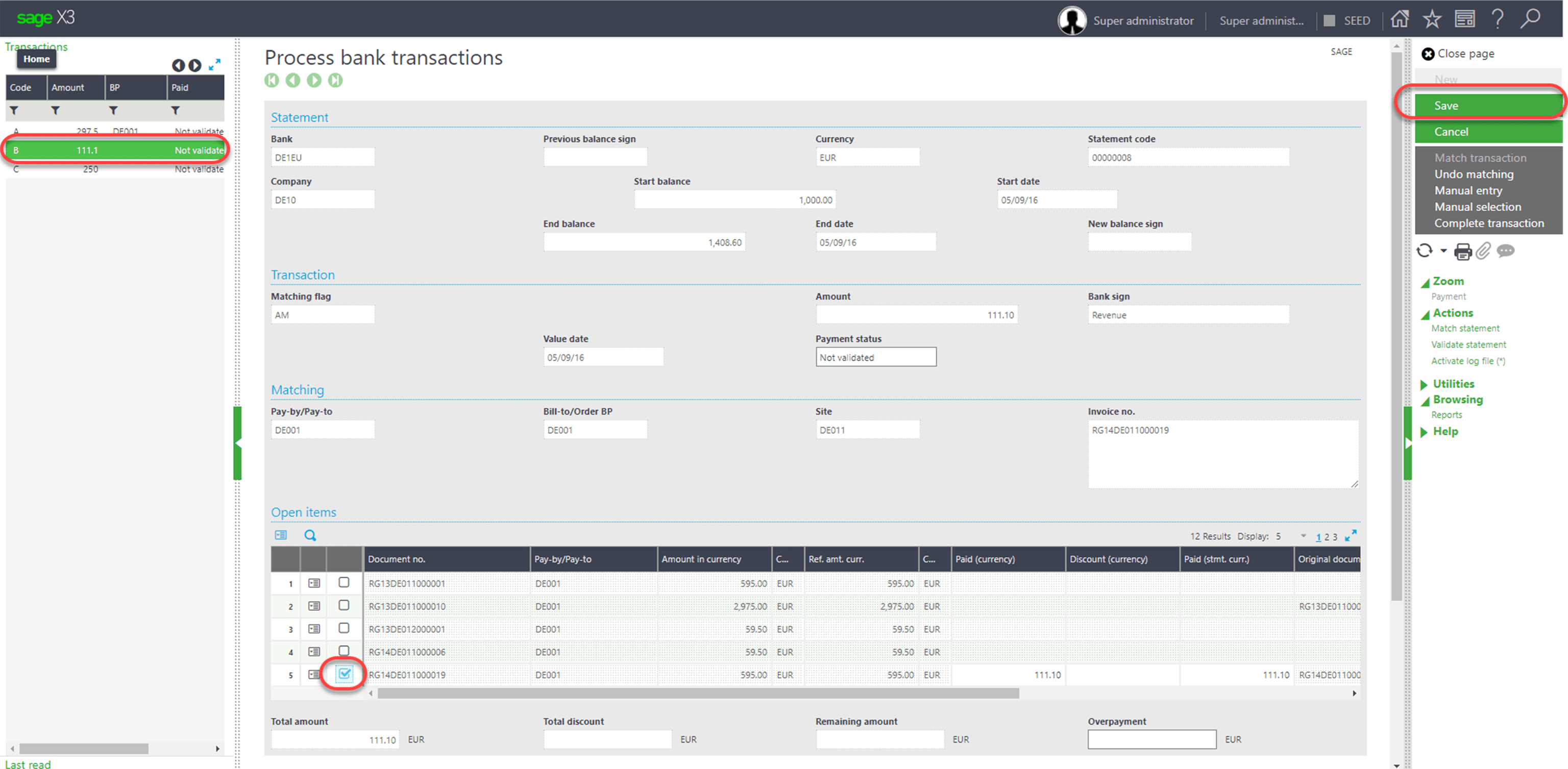

If we select the second transaction with status of ‘B’. In this case it was a partial payment, we can manually match this to an open item in the list and click save.

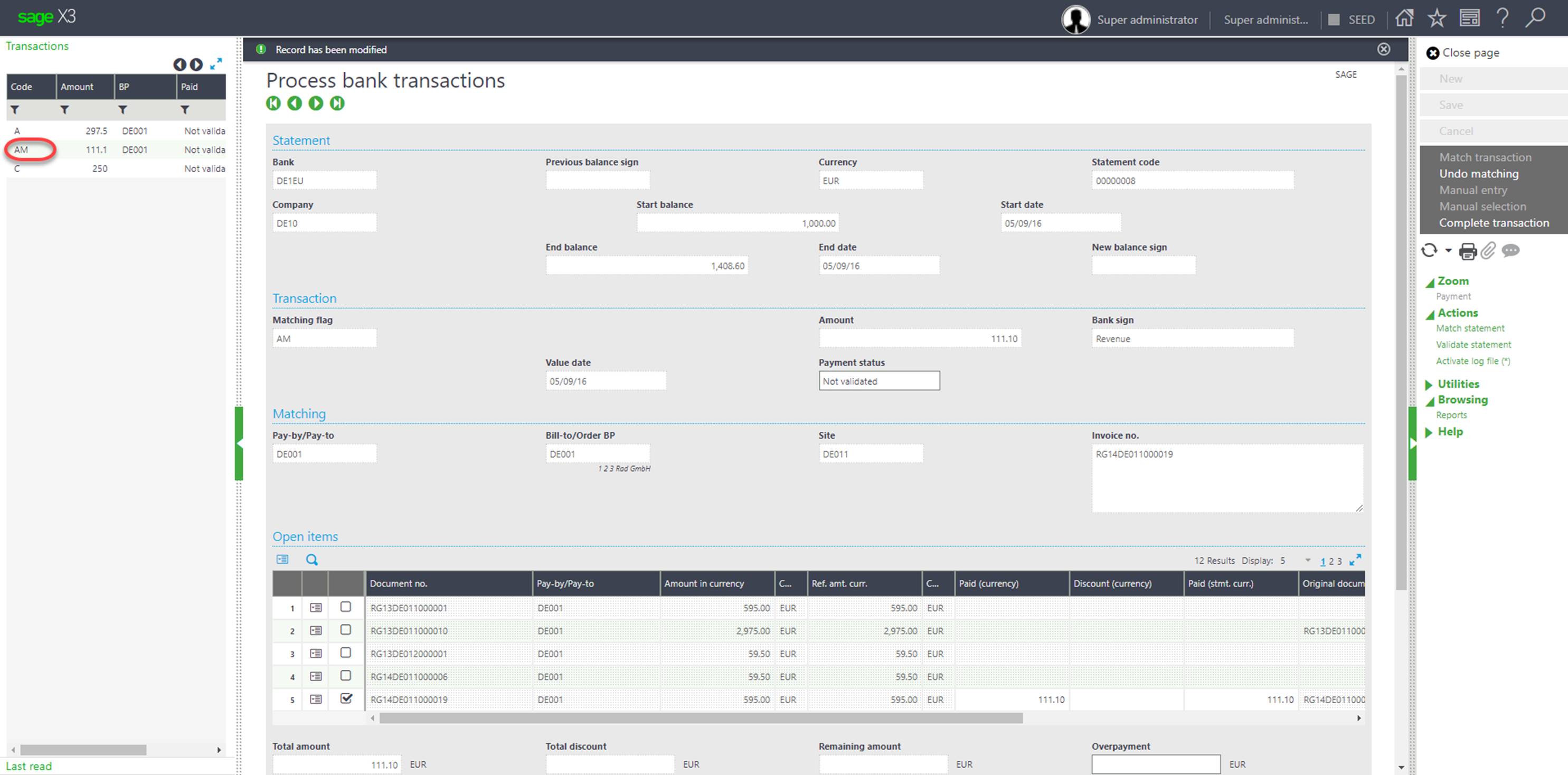

#6 – Once you save a change the status of the transaction will be updated, in this case AM which indicates it has been manually matched

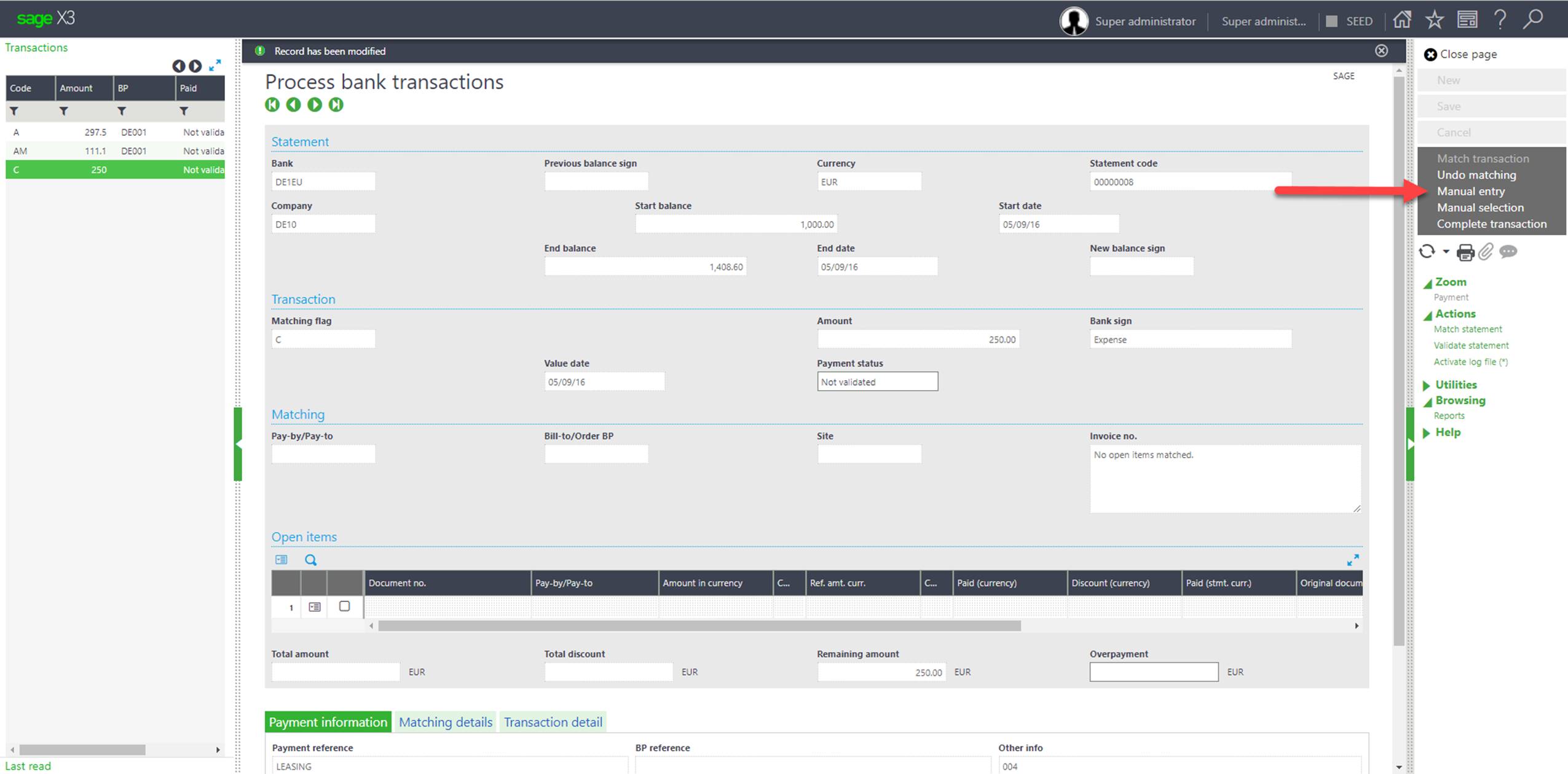

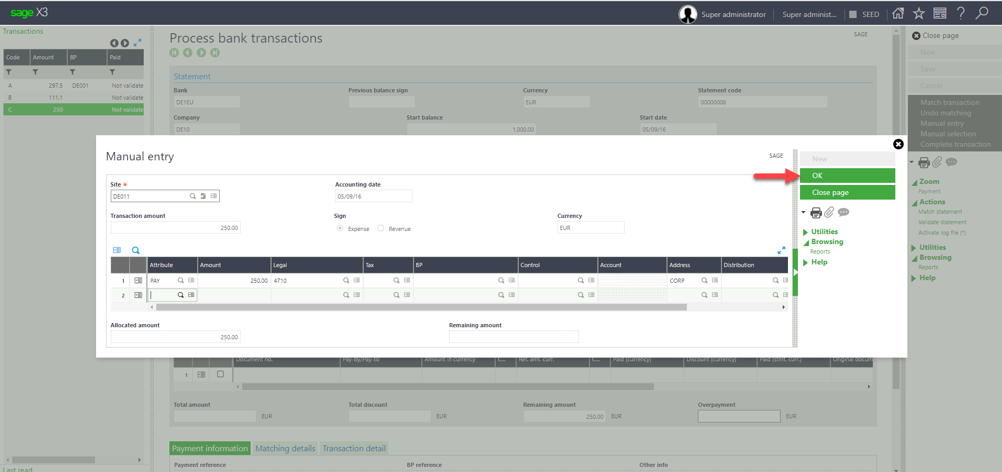

#7 – For C status transactions with no open items, you click on manual entry to create an open item, input payment details and then OK, changing the status to AD which means the transaction has been manually created and matched

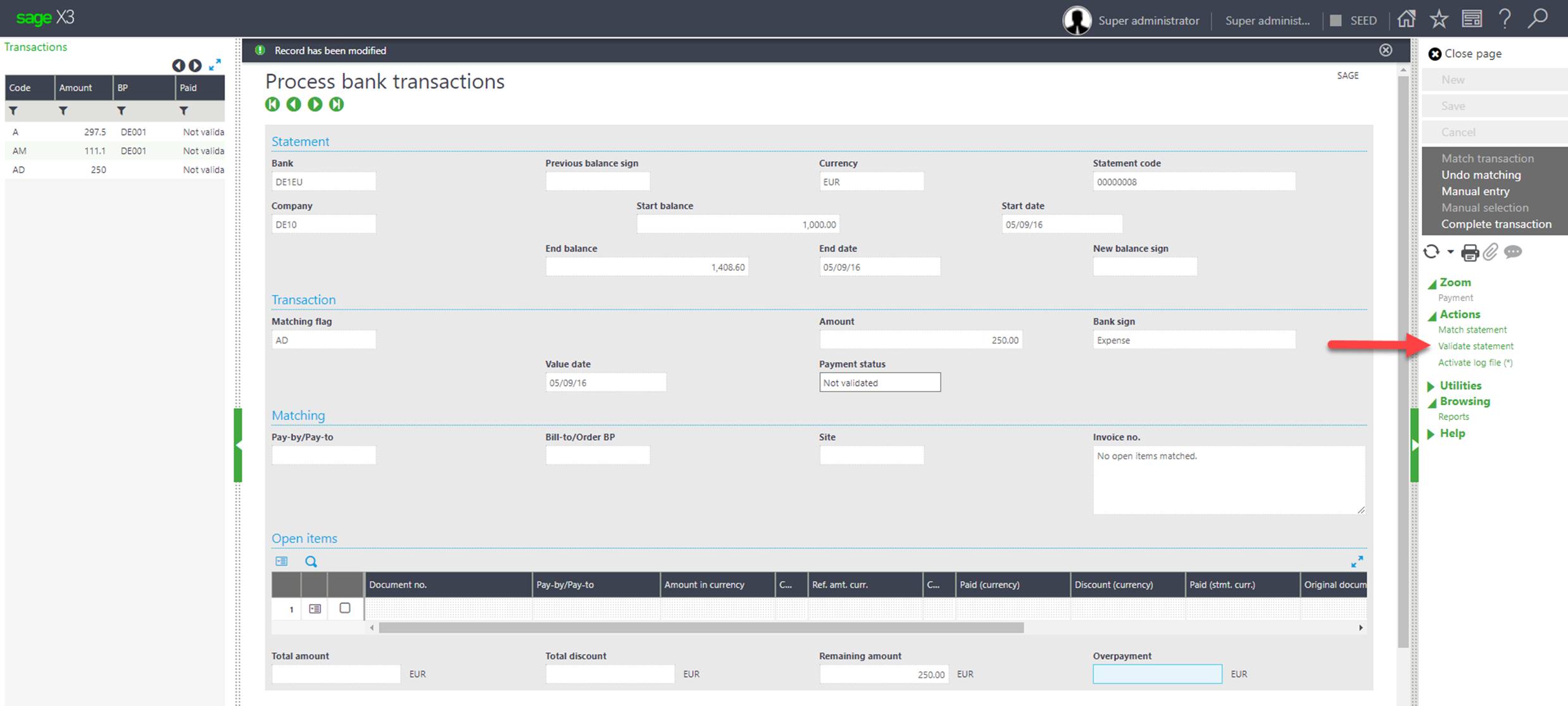

#8 – Once you’re done with matching all lines, you validate your bank statement which will generate your payments

Sage Enterprise Management’s accounting capabilities may not eliminate all manual matching, but it comes close. In addition, Sage Enterprise Management provides tools that make manual reconciliation easier such as the ability to sort and search by amount, type, description, date, and reference numbers.

Can you be confident in automated reconciliation?

Automating reconciliations between statements and ledgers—especially for multi-company, multi-site and multi-currency businesses—is made more effortless with Sage Enterprise Management’s rich finance features.

But ensuring the process is as accurate as possible does depend on expert configuration and testing. Leverage Technologies is adept at reflecting a company’s unique financial landscape within the Sage ERP solution, as well as undertaking testing to ensure the system is doing what is expected, so you can have high levels of confidence in the automated process.

For more information on Sage Enterprise Management and how it can help your business grow smart, call us on 1300 045 046 or email [email protected].

Brett has more than 20 years of business software sales and company management experience. Brett has been involved in more than 300 ERP projects. His passion is customer satisfaction, making sure every client is more than just satisfied. Brett wants our customers to be driven to refer their friends and peers because we offer the best services and technology available and because we exceeded their expectations.

Leave a comment